An Ad Valorem Tax Causes the Supply Curve to:

A specific unit tax will shift up the supply curve by the full amount of the tax so that the new curve is parallel to the original one as shown. Shift to the right.

Since we have a formula for the demand curve we can compute the change in demand xi - x i as a result of the tax.

. Shift to the right. An ad valorem tax Latin for according to value is a tax whose amount is based on the value of a transaction or of property. Shift to the left.

Changes in the price of a good lead to. For this will make our task of explaining the effects of the tax easier. Since the effect of this tax is on.

D shift to the left. It is sometimes called a sales tax. 18 The diagram shows the market supply and demand curves for wheat.

Technological advances will cause the supply curve to. Consumer Tax 18 10 x 10 8 x 10 80. A shift to the right.

Shift to the left. The quantity of tax is dependent upon the value of the good being bought. Calculating the tax area.

A A progressive tax usually improves the distribution of income. The formula for the good i demand curve is p i a i - b ixi or equivalently x i a i-pibi. An ad valorem tax causes supply curve to.

An ad valorem tax causes supply curve to. This means at lower prices the tax amount is less and at higher price there will be more tax. An ad valorem tax causes the supply curve to.

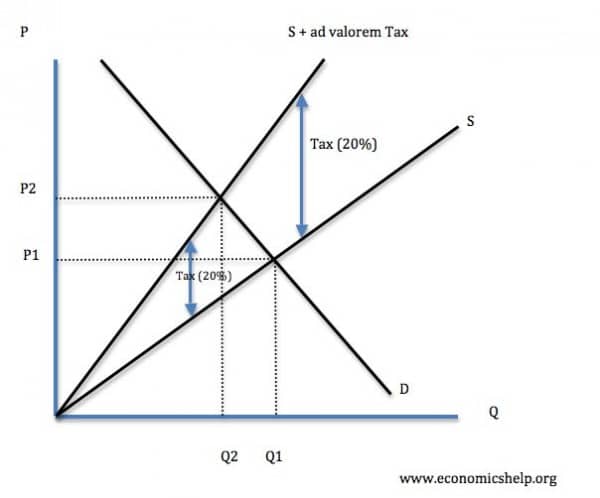

An ad valorem tax is a percentage tax imposed on a commodity at the time of sales. Regardless of the non-parrallel shift the burden of tax on the consumer and producer is calculated in exactly the same way as a specific tax. The imposition of an ad valorem tax will shift up the supply curve by a certain percentage meaning that the new supply curve will not be parallel to the original.

Shift to the left. In the supply and demand curves ad valorem taxes result in pivots. The amount of tax depends on the price.

Ad Valorem causes a non-parallel shift of the supply curve. Diagram of ad valorem tax. An ad valorem tax causes the supply curve to.

By rotating it clockwise. An ad valorem tax may also be imposed annually as in the case of a real or personal property tax or in connection with another significant event eg. B A regressive tax benefits the rich more than the poor.

An example of an ad valorem tax is VAT which is 20 in the UK. Taxes reduce the supply of a product. For example if we take VAT.

Figure 32 - The effect of ad valorem tax on the supply curve. Shift to the right. An ad valorem tax is a value-based tax.

This is because ad valorem tax is always the same percentage of the price therefore higher prices cause a steaper curve. Let us suppose that the demand curve for a good is DD in Fig. When either specific taxes or valorem taxes are imposed the market will shrink in size decrease in quantity thus possibly lower the level of employment in the market since firms might employ fewer people.

Producer Tax 10 7 x 10 3 x 10 30. Technological advances will cause the supply curve to. An increase in the amount of the tax results in an increase in the supply curve which results in an increase in the amount of.

Suppose the supply of good X is given by Q x 10 2 P x. The ad valorem tax causes a pivoted inward shift in supply and not a direct inward shift as shown below. How does ad valorem tax affect supply.

Do taxes usually increase the supply of a good or reduce the supply. Shift to the left. C An ad valorem tax causes a parallel shift left of the supply curve.

Shift to the right. Up by the amount of the tax. Mar 24 2022 0710 AM.

Shift to the left. Shift to the left. Down by the amount of the tax.

It is imposed in percentage terms and therefore higher the value of the goods higher is the ad valorem taxThe progressivity of a View the full answer. Multiple Choice shift to the right. How many units of good X are produced if the price of good X is 20.

Shift to the right. It is a value based tax. A tax shifts the supply curve to the left.

Shift to the left. An ad valorem tax causes the supply curve to. MCQ Academy English.

Shift to the right. It is typically imposed at the time of a transaction as in the case of a sales tax or value-added tax VAT. O price D P 1 KL R P 2 S output.

Technological advances will cause the supply curve to. Due to the fact that the amount of taxes paid by each individual varies depending on the type of tax one is paying this is the case. Shift to the right.

Shift to the right. Technological advances will cause the supply curve to. C become steeper.

Definition 1 Define the ad valorem tax rate of good i to be taxes paid per unit of sales of good i and denote that tax rate τi. Since the two types of taxes are very much similar to each other we can use only industry demand and supply curves to analyse the effect of an ad valorem tax. 2138 we show the effect of the imposition of an ad valorem tax on equilibrium price.

Whole Tax 18 7 x 10 11 x 10 110. Curve shifts up because it increases costs of production Figure 33 - Shift in supply curve due to indirect tax. Answer The ad valorem tax is an indirect tax imposed on the goods and based on the value or price of the good or item.

An ad valorem tax The imposition of an ad valorem tax will shift up the supply curve by a certain percentage meaning that the new supply curve will not be parallel to the original. Shift to the left. An ad valorem tax is levied as a percentage of the goods.

Suppose the supply of good X is given by QS x 10 2P x. Asked Aug 27 2019 in Economics by BrownBoa. We shall assume here that the tax is collected from the buyers rather than from the sellers.

An ad valorem tax causes supply curve to. How many units of good X are. D Some consumers can avoid paying indirect tax.

By rotating it counter-clockwise. An ad valorem tax shifts the supply curve. An ad-valorem tax always causes a pivotal rotation of the supply curve to the left as shown below.

Taxes are considered as a cost to the firm and an increase in. It is imposed as a fixed percentage of the price of a commodity. In the supply and demand curves unit taxes cause shifts.

Pin By Diarmuid O On Fun Economics Lessons Microeconomics Study Managerial Economics

Microeconomics And Macroeconomic Have Different Type Of Circular Flow This Circular Flow Is For Macroeconomic Study Info Macroeconomics Economics

0 Response to "An Ad Valorem Tax Causes the Supply Curve to:"

Post a Comment